Investing

Published for Tuesday - June 18, 2024

Written Sunday - 06/16/24 06:45 AM

I jumped out of BAC. I got out at 38.55

It's now sitting at 39.25, or 39.24 in the after market. It's been barely over 40 but there seems to be a wall at that point.

I'm still wrestling with whether or not I even want to be in the market. The only positive is that the trend still seems to be up in the overall market. Everything else is a big negative.

Included in the list of negatives is 1) a market that is very high 2) a high point in the 52 week range for BAC, and 3) still other things like whether or not I even want to be in a market since I really don't need to be in it.

Investing

Published for Thursday - May 16, 2024

Written Tuesday - 05/14/24 6:50 AM

I sold my Bank of America stock and it's going down like I hoped it would. I had originally thought about jumping back in about 25 cents lower but this may be a bigger drop, I just don't know.

I'm already down about 36 cents and may regret not jumping back in but I also don't want to jump back in just to discover this is the big drop that everyone is projecting.

Bank of America (BAC) is a great company with rock solid management. It's also high on Warren Buffett's list considering he is the largest BAC shareholder with about a 13% stake in the company.

Those are big reasons to be in this stock. But, I'm grateful that I don't need any extra cash and that's a big reason to wait for a crash.

Deciding not to try to time the stock is why I suppose I have done so well. And suddenly I'm trying to time a good point to jump back in and also whether or not I want to be back in anything. May not be a very good strategy.

Looks like the stock in dancing around in the pre-market. I think I might wait a while on this one. We'll see...

Dow Futures

Published for Tuesday - April 16, 2024

Written Sunday - 04/14/24 6:30 PM

I was so sure that Iran's attack on Israel and our involvement in the entire thing was going to pull down the market. It may still, but you wouldn't know if from the dow futures.

As I type right now the Dow Futures show +90 at 38,328.00. A bit earlier they showed +99 at 38,337.00 That may not hold up until tomorrow when the market opens but it's still surprising to say the least.

I'm a buy and hold on 1,000 shares of BAC (Bank of America) in at 27.75 and up over $8,000 at 35.79. it was up at 38.35 but has fallen off the edge in the last few days.

For the record, and although I'm still steering clear of this one, DJT (Trump Media and Technology Group Corp) is down at 32.59.

That's a long way down from the 60.50 where I jumped in and the 59.40 where I jumped out for a $110 loss on just 100 shares and not that many days ago.

Charles Schwab

Published for Tuesday - April 09, 2024

Written Friday - 04/05/24 5:15 PM

I made a note earlier in the investing category that I don't want to spend much time in this area. I was referring to trading, not a history of my activity in this arena.

Like I've said before, I don't want to get back into trading. I don't want to get back into a level that I was at previously. That was a lot of work.

I'm doing a buy-and-hold on Bank of America and that only because it did a big pull back to a screaming buy position. I don't want to do what I did recently with DJT stock. I knew it was risky when I did it and I'm very fortunate to have bailed out at a very small loss.

I lost $110 on 100 shares. Things could have been much worse. I could have had losses in the thousands. In fact, things did get worse because I fell back into that stressful groove for a very long weekend trying to manage my 100 shares of DJT stock. No more of that. I did that long enough.

When Patty and I moved to the Atlanta area, we went there with Amoco Fabrics and Fibers. I had joined the company while still in Savannah, GA with the idea that I would assist with the move of their I.T. operation to the West Atlanta area.

When I left Amoco and joined PeopleSoft, I moved my investing operations to the Charles Schwab company. Now I could get stock quotes over the telephone so, I ramped up my trading activities.

Looking back upon things, I was very fortunate to come out way ahead on a financial basis. I wasn't that smart, but was a good and careful student of investing. It paid off for me other than one very painful tax season.

I was Schwab's number one trader one year and with a business trip to New York City, they were able to get me out on the exchange floor. I also got to watch the market opening on the Chicago Board of Trade, which was quite something to see.

Oh, by the way, remember in Cobb County when the guy pulled out a gun and shot some people at that stock trading firm? That all happened right down the street from my PeopleSoft office. I was the last person to get out of the area before the police closed off traffic due to that shooting. I saw them do it in my rear-view mirror while driving down Peachtree Street late one afternoon after teaching class at the PeopleSoft office.

Bubble and Crisis

Published for Monday - April 08, 2024

Written Friday - 04/05/24 4:30 PM

I don't remember much about the dot com bubble of 1995. I just remember being very scared of the volatility in those stocks and basically steered away from them.

Looking back, that was a good move. I certainly could have made money off of shorting those stocks, but I have never been a short-seller. Frankly, I'm not smart enough to make money on that side of things.

On the other hand, I vividly remember the 2007-2008 Financial Crisis. I was in a job change when all of that took place and wasn't doing much of any buying or selling. I joined RightNow Technologies and left my technical sales position with Scott Armstrong's Firm.

Boy, was that ever a miserable situation. Nothing like having the company leadership make the news for illegal activity. That happened after I departed. Can't believe they asked me to vouch for some of them in a court of law. Why did they think I left?

Joining RightNow was also the reason I swapped from Charles Schwab to eTrade. It was a requirement to have an eTrade account as an employ of RightNow to receive stock from the company so I moved everything over to my new broker.

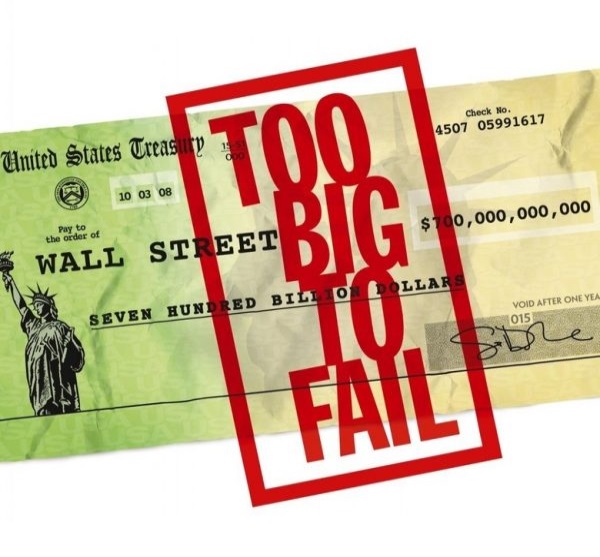

What I remember most about the Financial Crisis was two movies. One was called Too Big to Fail and the other was called The Big Short.

The latter of the two was a bit long for my taste but I really enjoyed the former. It was produced by H.B.O. and came out about four years after the event took place. It really painted the picture of that financial season and provided a clear perspective of how close the U.S.A. came to a financial calamity, despite the fact that things did indeed get pretty bad during that time.

Black Monday

Published for Sunday - April 07, 2024

Written Wednesday - 04/03/24 6:00 PM

I was riding home from the Georgia Ports Authority, where I was the system programmer. I was listening to the business news on the radio and the guy said that the Japanese were concerned about something and were pulling money out of our market. That was good enough for me so I called my broker the next morning and requested that he sell everything in my account and move me to cash.

I'll never forget his response. He called me some very bad names and said that in this biggest bull market of all times I would surely come to regret my decision. I had no idea what I was doing but stuck to my guns, in true Hutch DeLoach fashion, and now I was sitting on a small pile of cash and nothing else.

Monday of next week was October 19, 1987 - Black Monday as it was later to be called. The Dow dropped 22.6%. My broker lost everything and had to leave the firm and move back in with his parents.

I wish I could say that I was smart enough to do some buying but I wasn't. In true Peter Lynch style I waited for the knife to fall, stick in the ground, and wobble a bit before I once again became a buyer. I don't think I would have had the stomach to endure any earlier purchases. There was just too much up and down for me.

Turns out the Japanese were right. Getting out of everything was probably the best move I ever made in the stock market - especially since I had discovered margin and was utilizing it heavily. Had I been leveraged like usual I hate to think what might have happened to me in all of my ignorance of just how far the market can fall.

E. F. Hutton

Published for Saturday - April 06, 2024

Written Wednesday - 04/03/24 5:00 PM

Not long after I moved to Savannah, I decided to get involved in the stock trading world. Back then, I doubt it was referred to as stock trading unless one was super wealthy and could afford that kind of thing.

That's because everyone worked through a broker and you had to pay a commission for the broker's services each time you purchased or sold something. And those commissions were expensive. To the tune of over $100 per trade. That's over $100 to get into something and another $100+ to get back out.

So, that means you had to hold something long enough for it to cover the broker's commission. It was not like today where you can often get into or out of something without any extra fees and you can do it quickly, online, and all by yourself.

Some of the E.F. Hutton offices were empty. I tried to get permission to do my own trading but to no avail. I was too young to know what I could and couldn't do. My young broker was very patient with me. He had to be, LOL!

I remember the first time I used his services to buy some options. The stock was very cheap, whatever it was, but the options literally tripled overnight. My broker was out the next day so I utilized the services of another broker to get out of those options and capture my profits. The trading bug had taken a bite out of me and I was hooked.

Investing

Published for Thursday - April 04, 2024

Written Tuesday - 04/02/24 6:30 PM

Well, with some fear, I've added another topic to the menu. Investing.

I say 'with some fear' because I don't want it to be a topic where I spend a lot of time like I used to do. Me and the idea of investing go back a long way together and we've gone through lots of technology along the way.

Years ago, I purchased a Vic 20 computer (which was a lead up to the Commodore 64) and developed a stock quote device. My Vic 20 would make a free call to the Dow Jones News line and obtain stock quotes.

The Vic 20 would then hang up the phone line and call my pager (in the old days well before we had cell phones) and send just the stock prices. It was up to me to remember the order in which they were being sent, since pagers did not allow for letters that would have been used to send the company stock symbols.

Converting the stock price to something that was meaningful was the goal. (Stock prices started out using eighths.) For example, IBM might be 100 3/8. Using today's terms that would be the same as 100.375 so I would send 1100375 and have to do the mental conversion to arrive at the original stock quote.

The first digit (in this case a 1) indicated the order of the stocks (which means I could send 9 quotes.) The other 6 (or less) digits represented the stock price.

I would also have to remember that IBM was the first quote in the list. Usually I could tell which stock was being sent because of the approximate price and did not often have to remember the order of stocks being sent. The trick was in the software that was used to do these conversions on the front end.

Once the stock prices had been sent, the pager vibrator would go off and they would show up on my pager. Then the Vic 20 would hang up the line, wait ten minutes or so, and do it all again. If I had to attend a meeting, the pager vibrator could be turned off with the push of a button. It was that simple.

In future posts, I will share more about my time with EF Hutton in Savannah, Ga where I had to use a broker for trades, and my time with Charles Schwab in Atlanta, GA, where I finally could do things online.

Some years later I swapped to Etrade who was recently purchased by Morgan Stanley. I still sign into my old Etrade account as I have always done before, even though they are now owned by Morgan Stanley.

I also want to write about Black Monday - October 19, 1987, the 1995 Dot Com Bubble, and the 2007-2008 Financial Crisis. Should be interesting.

Volatility

Published for Wednesday - April 03, 2024

Written Monday - 04/01/24 8:45 AM

Well, I lost $110 on DJT. I woke up this morning down more than $300 in the pre-market and stated to bail out but the stock started climbing.

I purchased the stock last Thursday in the after-market for $60.50 and promised myself that if it dropped below $60.00 I was out.

DJT jumped around in the mid $59's (still in the pre-market) and I was out at $59.40. Next time I looked it was up in the $60's. Oh well, can't win 'em all.

I just looked again and it's down @ $56.31. Had I waited and bailed out at this point I would have lost $419. Getting out turned out to be a good move after all.

I don't plan to play with DJT anymore. Too volatile and too risky for my blood.

Addendum: 04/01/24 12:05 PM

Can't believe DJT is now down in the low to mid 45's. Currently 45 and change. Big and negative news pulled it way down = -26%. Like I said, too risky for my blood.

Addendum: 04/01/24 06:10 PM

Can't believe DJT closed down at $48.66 and is further down at $47.70 in the after-market. Up from the low of the day but still way down and more than -23%.

Thursday

Published for Saturday - March 30, 2024

Written Friday - 03/29/24 6:50 AM

Yesterday, our handyman brought in 4 truck loads of nice topsoil and then put down grass seed on top of it and then straw on top of all of that to hold it in place. He then wet the straw to hold it in place from all of the wind.

Meanwhile, Patty and I were out to lunch with our son where we all enjoyed some nice Thai food at Kati Thai Cuisine in Gadsden, AL. It was a good day all around.

I also invested in 100 shares of DJT in the after market. The stock got down to where I wanted to enter and I purchased a very small number of shares. Depending upon how things look, I may or may not stay with it. We'll see...

As I write, and as you can see above, it's Friday. However, I forgot that it is Good Friday and that the markets are closed today. Guess I'll wait until Monday to see how things look.

Stock

Published for Friday - March 29, 2024

Written Wednesday - 03/27/24 6:50 PM

Six months ago, almost to the day, I purchased some stock. I wasn't going to do that anymore but Bank of America (my go to when I am buying stock) got down where I said I would buy in so I did just that.

The stock promptly dropped about two dollars-worth, but I had already decided that this was going to be one of those buy and hold situations. That turned out to be a good idea.

I'm up over $10,000 and wondering if I should go ahead and continue to ride or should I listen to all the naysayers and sell out now. I've always been a contrarian which means I should hold.

In fact, the naysayers have been suggesting I sell for some time now. I'm where I'm at because of my contrarian style, so I'm doing what I probably shouldn't do and going into a very long-term hold.

That may be a bad idea but this is a stress-free situation because I doubt it will drop 10+ points back down to where I bought in. That would be over 25% of its present value.

I've also been watching the new DJT (that's Donald J. Trump's stock for his Truth Social Company.) Looks like he did very well with it and it's been fun to watch.

Copyright © 2024 Hutch DeLoach